Institute of Advanced Investment Management

Recent Research

IAIM is excited to share the insights from our latest research, which provides a comprehensive overview of the trends and challenges facing the finance industry. Our report draws on data from a range of sources, including surveys of investment professionals, market analysis, and academic research, to provide a detailed analysis of the key drivers shaping the industry. The findings highlight the growing importance of technology and digital innovation. We believe in the need for continued innovation and collaboration in the face of ongoing disruption. We believe that this research provides valuable insights for investors, asset managers, and other stakeholders, and we look forward to sharing these insights with the wider community.

Firm Characteristics, Return Predictability, and Long-Run Abnormal Returns in Global Stock Markets

We show that characteristics known to predict returns to U.S. stocks also predict returns for a broad sample of nearly 52,000 stocks from fifty-eight non-U.S. countries, and we evaluate the extent to which six prominent corporate events, including initial and secondary stock offerings, stock repurchases, dividend initiations, stock splits, and merger announcements, are associated with apparently abnormal post-event returns for non-U.S. stocks.

Read more: Firm Characteristics, Return Predictability, and Long-Run Abnormal Returns in Global Stock Markets

How Do Firms Respond to Corporate Taxes?

Using a novel empirical approach and newly available administrative data on U.S. tax filings, we estimate the corporate elasticity of taxable income, decompose the elasticity into economic responses versus other tax-motivated “accounting” transactions, and determine how responsiveness varies depending on accounting method, firm size, and interest rate.

Read more: How Do Firms Respond to Corporate Taxes?

Political Attitudes and Equity Market Reactions to Vaccine Mandate Bans

In 2021, many firms began considering and implementing vaccine mandates as a means to return workers to in-person work. In response, twelve states enacted laws banning employer COVID-19 vaccine mandates.

Read more: Political Attitudes and Equity Market Reactions to Vaccine Mandate Bans

Prices Are Less Elastic For Less Diversifiable Demand

We hypothesize and provide evidence that prices are more inelastic when demand is less diversifiable. Specifically, we decompose order-flow imbalance into several components with varying degrees of diversifiability and estimate their price impacts.

Read more: Prices Are Less Elastic For Less Diversifiable Demand

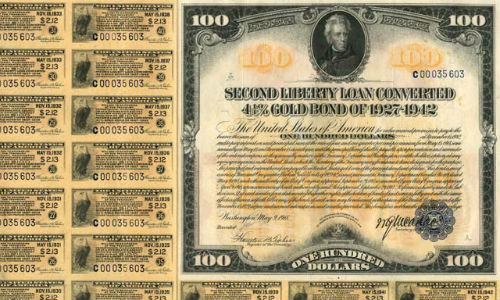

The Broken Bond Market

Valued at around $10 trillion, the U.S. corporate bond market is slow, expensive, and inefficient. This Article argues that the bond market – premised on contract – rests on a flawed regulatory design that delivers neither investor protection nor market quality.

Read more: The Broken Bond Market

Does Floor Trading Matter?

While algorithmic trading now dominates financial markets, some exchanges continue to use human floor traders. On March 23, 2020 the NYSE suspended floor trading because of COVID-19. Using a difference-in-differences analysis around the closure of the floor, we find that floor traders are important contributors to market quality.

Read more: Does Floor Trading Matter?

Investment Differences Between Public and Private Firms: Evidence From U.S. Tax Returns

Using tax data, we compare the investment behavior of public and private firms for a representative sample of all U.S. corporations. We find that while both types of firms invest similarly in physical capital, public firms out-invest private firms in R&D.

Read more: Investment Differences Between Public and Private Firms: Evidence From U.S. Tax Returns

Household Asymmetric Risk of Foreclosure From Tax Assessment Limits

Homeowners face risk due to variation in annual property tax liabilities which may result in financial distress and eventual mortgage foreclosure. We show that an unintended consequence of a common property tax feature, assessment limitations, exposes households to more systematic risk despite decreasing the variance of property tax payments.

Read more: Household Asymmetric Risk of Foreclosure From Tax Assessment Limits