Institute of Advanced Investment Management

Institute of Advanced Investment Management

Masters Student Investment Fund

Weekly Updates

Each week, the MSIF team prepares and presents a comprehensive update designed to keep members engaged with current market conditions and the fund’s evolving performance. These updates are led by rotating team members and serve as an opportunity to practice clear communication, develop market awareness, and strengthen portfolio oversight. After the live presentation, content is reviewed by the copy and editing team and published to the website. The update includes two core components: a Portfolio Performance summary that tracks key metrics and strategy outcomes, and a Macro News section that highlights major economic and market developments shaping the broader investment landscape.

Portfolio Performance

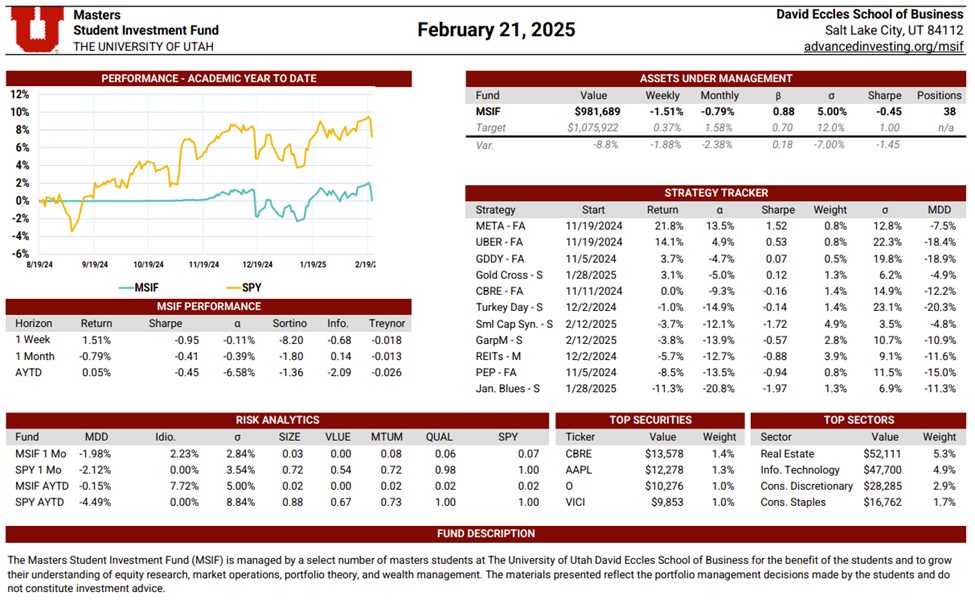

The MSIF Portfolio Update is a dynamic, continuously maintained document that provides a detailed view of the fund’s positioning and performance. Updated weekly by rotating team members, it includes performance metrics such as weekly and academic year-to-date returns, Sharpe ratio, alpha, beta, volatility, and maximum drawdown—benchmarked against our stated performance targets. The update also evaluates the contribution of each active strategy, highlights sector exposures, and presents the fund’s top holdings by dollar value. Designed to serve both as a performance dashboard and a risk management tool, this document supports informed decision-making and disciplined portfolio oversight.

Macro News

The Macro News Update is a weekly publication maintained by rotating MSIF team members to track key developments across U.S. and global markets. Each edition begins with a summary of major economic and geopolitical headlines, providing timely context around events shaping investor sentiment. The update also reviews sector performance over one-month and twelve-month periods relative to the S&P 500, followed by a weekly comparison of major indices including the S&P 500, Nasdaq, and Dow. Additional sections cover short-term commodity movements and key economic indicators—such as inflation, interest rates, unemployment, and dollar strength—offering a comprehensive snapshot of the macroeconomic landscape. This resource plays an essential role in helping the team stay informed, assess shifting market conditions, and make thoughtful, data-driven adjustments to portfolio positioning.